Calculate reverse mortgage

A reverse mortgage is a type of mortgage loan only available to homeowners aged 62 or older. It does not become due for as long as the homeowner lives in the property as their primary residence continues to pay required property taxes and insurance and maintains the home according to FHA.

Pin On Real Estate Tips News And Market Updates

The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term.

. Youll find that there are many people today who are using reverse mortgages for a variety of reasons. Retire better with an AAG reverse mortgage loan designed to help seniors 62 and older leverage their home equity to supplement their retirement income. 1 Can pay off existing mortgages on the home.

A HECM is different from all other types of mortgages. Download our FREE Reverse Mortgage Amortization Calculator and edit future appreciation rates. A reverse mortgage can be a true path forward in retirement.

Pros of Reverse Mortgages. This is a particularly useful advantage if you secure a. Speak to a real person now.

Also Reverse Mortgage Lenders have no claim on your income or other assets. When the loan is due and payable some or all of the equity in the property that is the subject of the reverse mortgage no longer belongs to borrowers who may need to sell the home or otherwise repay the loan. Keep in mind that with a low down payment mortgage insurance will be required which increases the cost of the loan and will increase your monthly payment.

FHA reverse mortgages can charge a maximum of the greater of 2500 or 2 of the maximum mortgage claim amount of 200000 1 of any amount above that. Request your free estimate today. Get Started with Reverse Mortgage.

How much house can you afford. Wells Fargo offers several low down payment options including conventional loans those not backed by a government agency. Whether youre the borrower on the reverse mortgage or an heir take time to consider your options.

The most common use is to pay off an existing mortgage. Negative points which are also referred to as rebate points or lender credits are the opposite of. If you are within 6 months from your next birthday I will automatically calculate you a year older.

Get Your Estimate. Call AAG at 800 224-9121. Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan.

Calculate your mortgage payment. No monthly mortgage payments are required however the homeowner must live in the home as their primary residence continue to pay required property taxes homeowners insurance and maintain the home according to Federal Housing Administration. Getting numbers on paper even estimates is a great way to gain an understanding of your options.

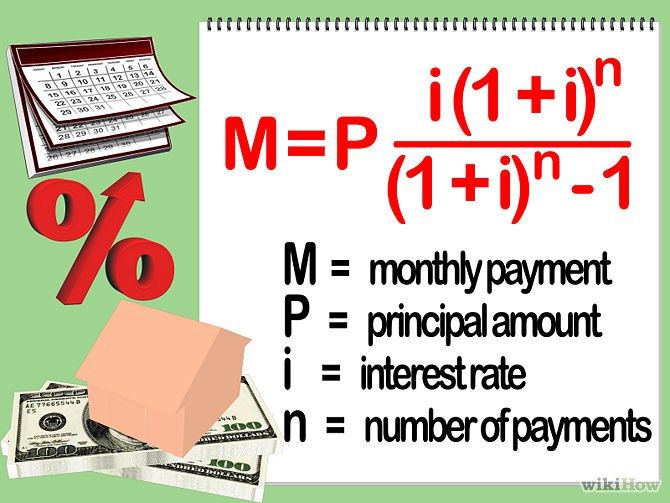

Free Reverse Mortgage Calculator Calculate. Allows the homeowner to stay in the home. Using a mortgage calculator can help you calculate monthly payments on a home loan.

Across the United States 88 of home buyers finance their purchases with a mortgage. Dont forget to include your spouses age even if they are not yet 62 as loan proceeds are always based on the age of the youngest. An AAG specialist can calculate your exact fees and rates based on the loan options you choose.

If you are shopping for the best reverse mortgage interest rate be sure to first compare the programs payment options explained in detail below. Many prospects first gravitate to a fixed rate but find the mandatory lump sum unattractive when compared to the flexibility of a line of credit option or monthly payment plans featured on variable interest rate options. CHIP Reverse Mortgage from HomeEquity Bank is Canadas top provider of reverse mortgages.

With a Reverse Mortgage you will never owe more than your homes value at the time the loan is repaid even if the Reverse Mortgage lenders have paid you more money than the value of the home. Conventional fixed-rate loans are available with a down payment as low as 3. Calculate your loan estimate.

Reverse Mortgage Calculator Mls Mortgage Reverse Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator

Reverse Mortgages What To Know Visual Ly Reverse Mortgage Mortgage Info Mortgage Marketing

Pin On Reverse Mortgage California

55 Brilliant Mortgage Direct Mail Postcard Advertising Examples Reverse Mortgage Mortgage Marketing Mortgage

Pros And Cons Of Getting A Reverse Mortgage Reverse Mortgage Refinancing Mortgage Mortgage Marketing

You Ve Seen The Slick Commercials About How Great Reverse Mortgages Are But Are They Really All They Re Cracked Reverse Mortgage Invest Wisely Mortgage Humor

Calculate Mortgage Rates With The Mortgage Calculator Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage Loan Calculator

Infographic How Can You Use Home Equity Reverse Mortgage Home Equity Mortgage Amortization Calculator

Sign In Reverse Mortgage Things To Sell Selling House

The Essential Reverse Mortgage Factsheet Visual Ly Reverse Mortgage Mortgage Refinance Calculator Mortgage Loans

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information Fha Loans Refinancing Mortgage Mortgage Loans

Mortgage Calculator Application App Development Companies Mobile App Development Companies Enterprise Application

Mortgage Calculator Mortgage Calculator Reverse Mortgage Amortization Calculator Revers Mortgage Amortization Mortgage Amortization Calculator Online Mortgage

Infographic Anatomy Of A Reverse Mortgage Mortgage Infographic Reverse Mortgage Mortgage Payment Calculator

Mortgage Payment Calculator Calculate Your Ideal Payment Mortgage Payment Calculator Mortgage Payment Mortgage

Idbi Bank Introduces Reverse Mortgage Loan For Senior Citizens It Seeks To Monetize The House As An Asset A Mortgage Loans Refinance Mortgage Reverse Mortgage

Reverse Mortgage Age Chart What Percentage Of Appraised Value Will I Get Reverse Mortgage Info Reverse Mortgage Refinance Mortgage Mortgage Calculator